Coding Goods And Services

In implementing the electronic invoice and electronic receipt system, the Egyptian Tax Authority uses international standards for coding goods and services to ensure:

- Exchanging services in a standard, unified and organized manner that reduces errors.

- Unifying the definition of these goods between the commercial parties (buyer and seller).

The Egyptian Tax Authority follows two standards:

GS1 standard – global standard

The first standard is the GS1 standard – global standard (where each good or service has a unique code that is not repeated worldwide and guarantees the product’s belonging to the manufacturer)

This standard is used by companies and organizations around the world to automatically identify products, platforms and locations and manage their supply chains more efficiently.

- A unified commodity code standard through the Global Data Synchronization Network (GDSN) allows companies that deal with each other to always have the same information in their systems.

- Any changes made by one company to its model codes are reproduced for all other companies that deal with it.

The financier can obtain this standard by contacting the gs1 code egypt agent and the agent’s website from the following link: https://gepir.gs1.org/index.php

Or through the hotline: 16841

egs code egypt -EGS – Egyptian Goods and services

The second standard is egs code egypt -EGS – Egyptian Goods and services, which is an Egyptian standard that is designed to be compatible with the nature of the activities of the Egyptian financier without financial compensation and consists of three sections: EG - the financier’s registration number - the internal code for the good or service and it is linked With the GPC - Global Product Classification standard, the coding structure can be viewed from the following link: https://gpc-browser.gs1.org/

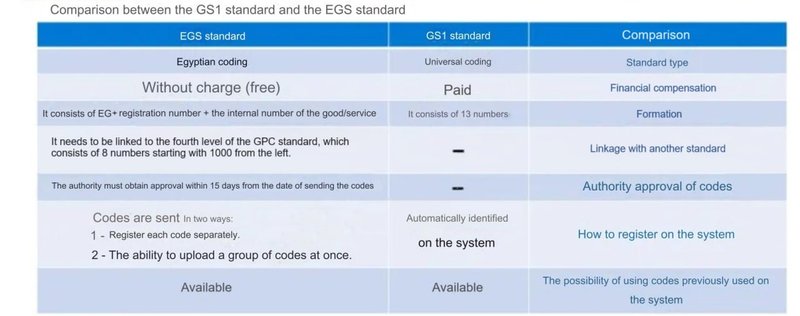

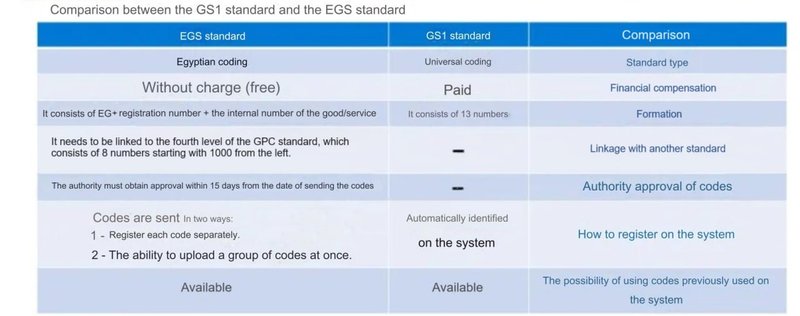

And this is a comparison between the 2 codes:

After obtaining one of the mentioned codes, the codes are registered through:

- Log in to the website (the taxpayer’s page on the electronic receipt or electronic invoice system)

- Enter the “Codes” menu

- Register new codes, one code at a time, or by uploading an Excel file containing the codes to the system.

- Then send the codes to the Tax Authority for approval (if you choose EGS) to complete joining the system. In the case of GS1, they are automatically defined in the system.

The feature of coding goods using the General Identification System for Goods and Services (EGS) in our Pulsar ERP system is among its most prominent advantages, as this system provides users with a simplified and effective experience in managing their taxes.

Our software allows users to obtain EGS codes easily, without having to create them manually. Thanks to the automatic coding function, Users can get codes with just one click. Thus, the program relieves users of the burden of additional and complex procedures, saves them time and effort, in addition to ensuring accuracy and understanding of local and international tax requirements.

Simply put, users can upload these auto-generated codes to their tax account, greatly facilitating the application and tax compliance process, and ensuring full compliance with applicable tax legislation.

Sources: https://www.eta.gov.eg/ar/content/e-receipt-services