Prepare to send the electronic receipts (e-receipts)

An electronic receipt is a document created upon the completion of a sale transaction between the financier and the end consumer (an individual) B2C and is sent to the Egyptian Tax Authority (ETA).

To start using the module for working with electronic receipts, you need to register your devices from which you will send your electronic receipts on the ETA website.

Registering Your POS Devices on the ETA Portal

Let's clarify first that, according to the Egyptian Tax Authority (ETA), every device used to send electronic receipts is called a Point of Sale (POS) device.

Please note! In the current version of the Pulsar application, receipts can only be sent to the Egyptian Tax Authority (ETA) if they are generated through the personal Pulsar account or via the Cashreg program designed for sales on the computer.

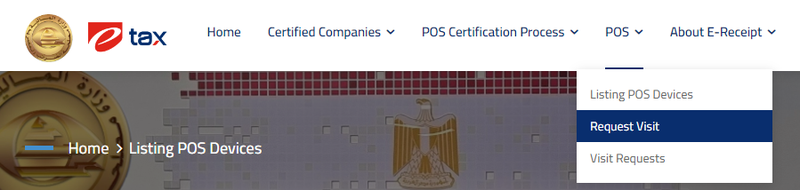

- In your personal account on the eTax website, submit a request for point of sale certification.

2. When the eTax representative arrives, inform them that you will be sending electronic receipts through your inventory control application Pulsar, installed on your computer (Vendor - PSR_TEMP).

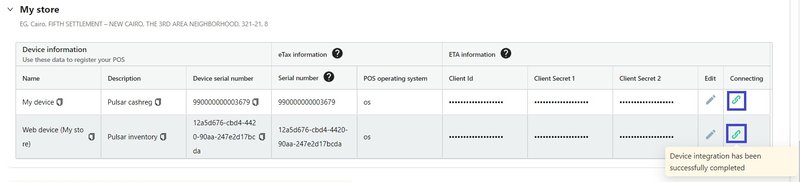

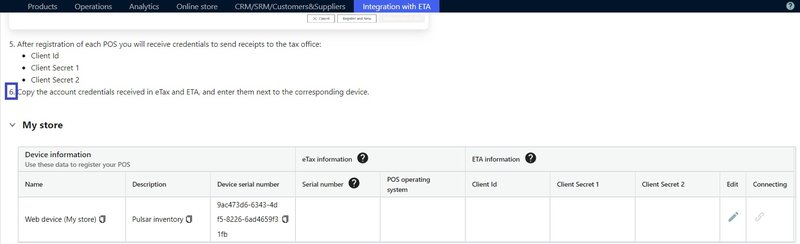

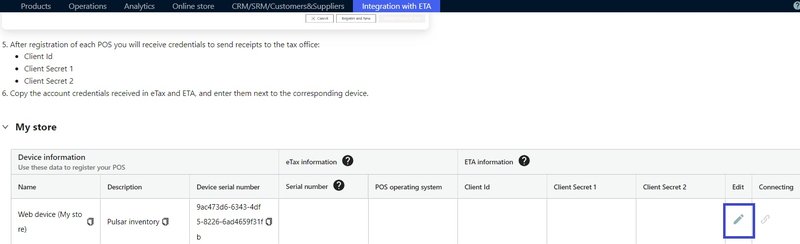

You can find the list of devices available for sending electronic receipts to the tax authorities, which need to be coordinated with the eTax representative, in your personal account in the Pulsar system under the Integration with ETA tab >> Connecting >> E-receipts for sale to individuals >> under step number 6.

Please note! that you need to register each device from the table.

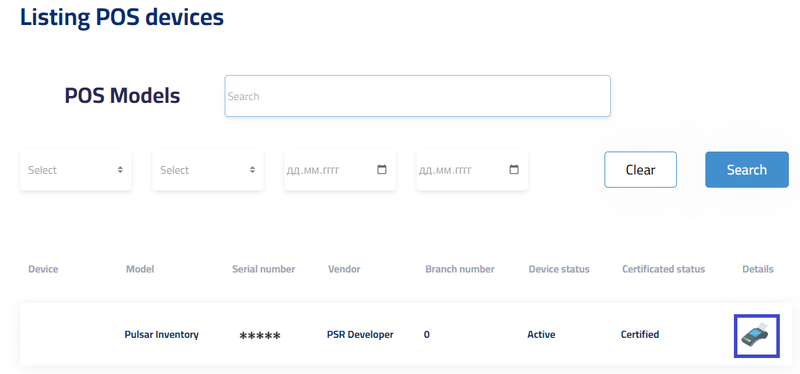

3. After certifying your point of sale, you will see a list of certified POS devices on the eTax website.

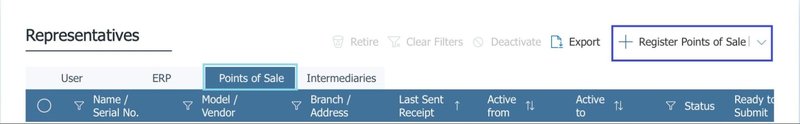

5. Go to the Representatives section and register your sales points there. In the Points of Sale section, click on the Register Points of Sale button.

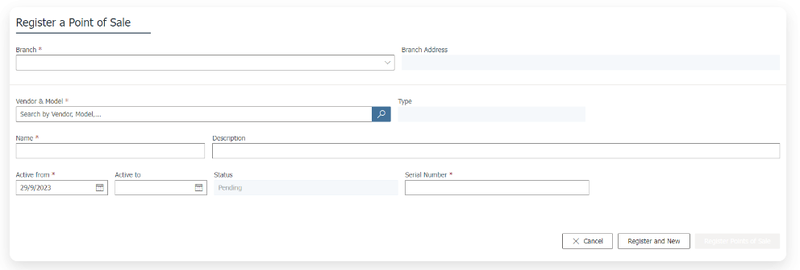

6. The Register point of sale window will open.

In this window, provide the information that you see under the additional details section in the list of certified POS devices in your eTax account.

7. After entering complete and correct information, click on Register point of sale.

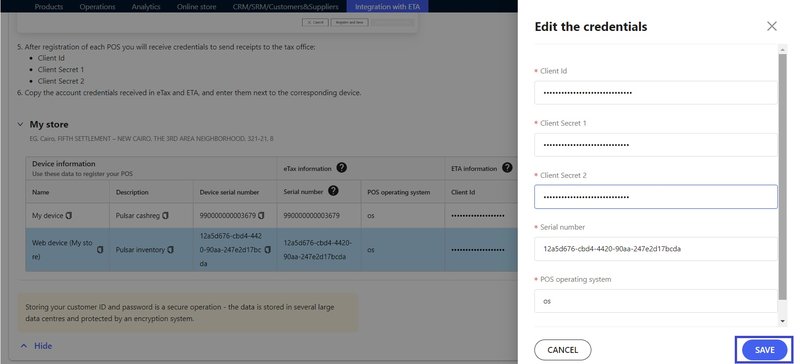

8. Once you register your Point of Sale on the Egyptian Tax Authority's (ETA) electronic website, you will receive in your personal taxpayer account the specific details needed to send electronic receipts. These details include:

- Client ID.

- Client Secret 1.

- Client Secret 2.

9. Enter them into the Pulsar system in the sixth step of connecting electronic receipts, by clicking the pencil icon next to the appropriate device you want to connect (i.e., setting up integration with the electronic receipt system).

10. Enter these keys and your device's operating system, also copy the device serial number from the same table and click Save.

11. The green indicators will inform you that the device is ready to send electronic receipts to the Egyptian Tax Authority (ETA).