Send the electronic receipt (e-receipt) to ETA

An electronic receipt is an important document that must be prepared when a financier sells something to the final consumer (Individual) in a B2C transaction and sends this document to the Egyptian Tax Authority ETA. The electronic receipt can be sent to the Egyptian Tax Authority within 24 hours of the sale.

To simplify the sending of these electronic receipts and avoid errors, you can use the dedicated section in the Pulsar web application. To do this, you must register your devices (POS) on the ETA portal. This will help you save time and streamline the process of submitting information to the Egyptian Tax Authority (ETA).

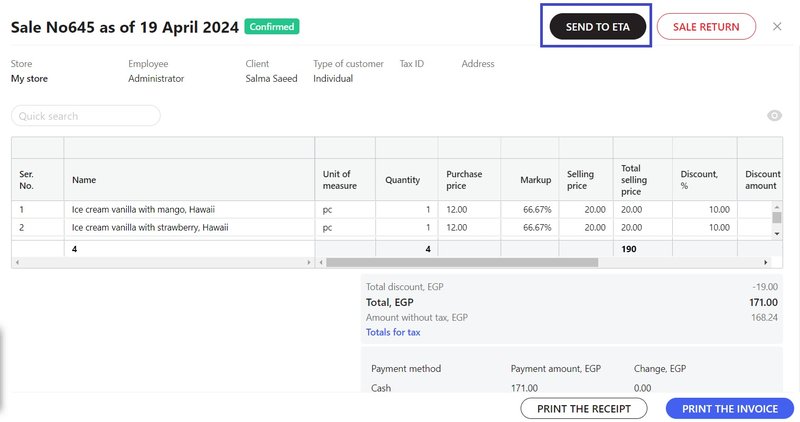

Sending the electronic receipt (e-receipt) from Sale Operation

The Pulsar application allows sending electronic receipts to the Egyptian Tax Authority (ETA) when creating a sale operation with an end consumer (individual). Here's how to do it:

- Create the sales operation following the provided instructions.

- Ensure compliance with ETA's requirements for issuing receipts:

- In the customer field, ensure to include the name and national ID number of the buyer if the amount exceeds 150,000 Egyptian pounds. If the customer is a foreign national, regardless of receipt value, you also need to include the name of their country.

- Goods and services to be sold must have GS1 or EGS barcodes approved by ETA.

- Fill out your company information and store address.

Please consider these points to ensure smooth sending of electronic receipts and to avoid errors.

3. Complete the sale operation and click the Send to ETA button.

Please note! The Send to ETA button may not be available for activation. If this happens, hover your mouse cursor over the disabled button to understand the reason for its unavailability.

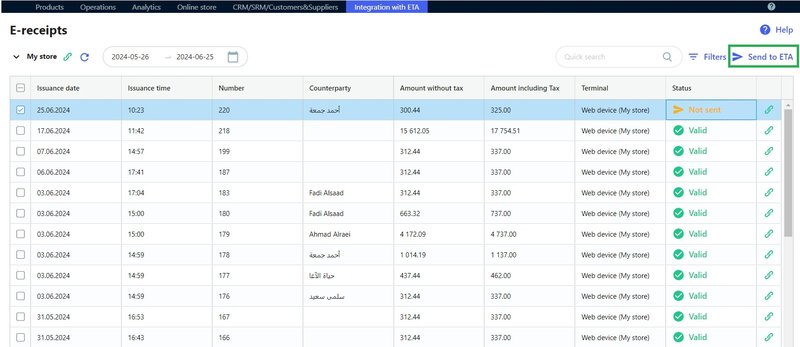

You can view all electronic receipts and their statuses in your personal account on the Pulsar web-application under the Integration with ETA tab >> Electronic Receipts. Additionally, receipts sent to the Egyptian Tax Authority (ETA) will appear directly in your personal account on the ETA Tax Portal.

Sending the electronic receipt (e-receipt) from the Electronic Receipts Register

In the Integration with ETA tab - Electronic Receipts section, you will find a list of all electronic receipts generated in your inventory management application.

To send an electronic receipt from this list, follow these steps:

- Ensure the connection indicator is green. If the connection indicator is red, check the integration settings with the Egyptian Tax Authority ETA system.

- Select the electronic receipt you want to send to ETA and have not yet sent.

- To quickly find the receipts you need, you can use the quick search window and filters:

- By point of sale (store),

- By date,

- By receipt status,

- By point of sale-device (POS),

- By integration status with the electronic receipt system.

4. After selecting the electronic receipt (e-receipt) you want to send, click the Send to ETA button.

The electronic receipts (e-receipts) sent to ETA will appear immediately in your personal account on the ETA electronic receipt (e-receipt) online portal.

5. To see the latest information about the electronic receipts (e-receipts) statuses at ETA, update your electronic receipts (e-receipts) list.

Electronic Receipt Statuses

Understanding the statuses of electronic receipt submissions to the Egyptian Tax Authority (ETA) helps you easily navigate your document list and quickly find the documents you need using filters.

Here's what each status means for sending electronic receipts to the Egyptian Tax Authority (ETA):

- Not Sent - A document that has not yet been sent to the Egyptian Tax Authority (ETA).

- In processing - A document currently being processed by the system for submission to the Egyptian Tax Authority (ETA). The status will change to Submitted once the submission process is complete.

- Submitted - A document that has been successfully sent to ETA and is under review. After review, it may become Valid or Invalid.

- Valid - A document successfully accepted by the Egyptian Tax Authority (ETA).

- Invalid - A document rejected by the Egyptian Tax Authority (ETA) due to errors or non-compliance with rules, which needs to be corrected and resubmitted.

- Cancelled - A document cancelled by the seller. To cancel a sent receipt, you need to go to the Egyptian Tax Authority (ETA) portal and create a sales return receipt, based on the original sale receipt. The system allows for sending sales return receipts within a maximum of 18 months from the receipt issuance date.

- The status could not be obtained - If you see this status, it means the system was unable to get information from the Egyptian Tax Authority (ETA). Wait a few minutes and refresh the list. If the status does not change, contact the technical support.