Entities that pay tax must submit reports on their activities to ETA. The correct filling in of tax reports provides not only for the company's compliance with tax legislation, but also helps to avoid any fines and issues with the regulatory authorities.

The Tax Report will help you quickly and correctly fill in the tax reports, calculate the amount of assessed sales tax, and check Tax rates on products and operations.

Generating a report

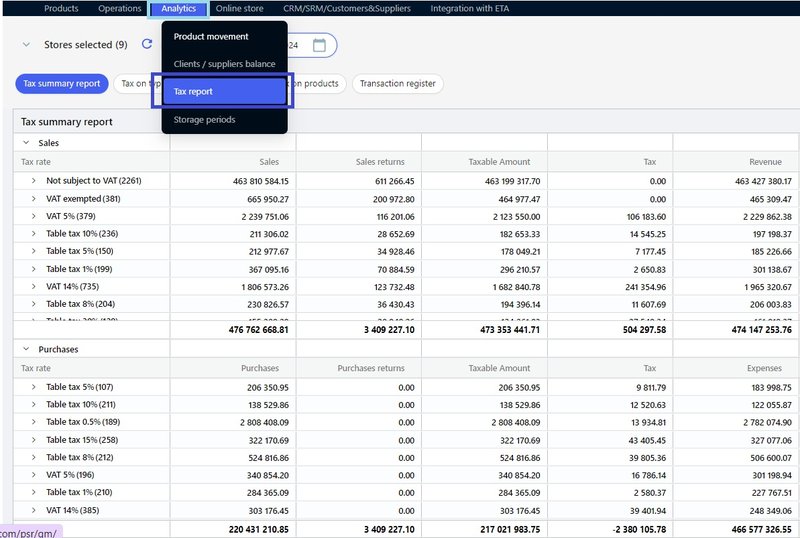

Go to the Analytics → Tax report tab.

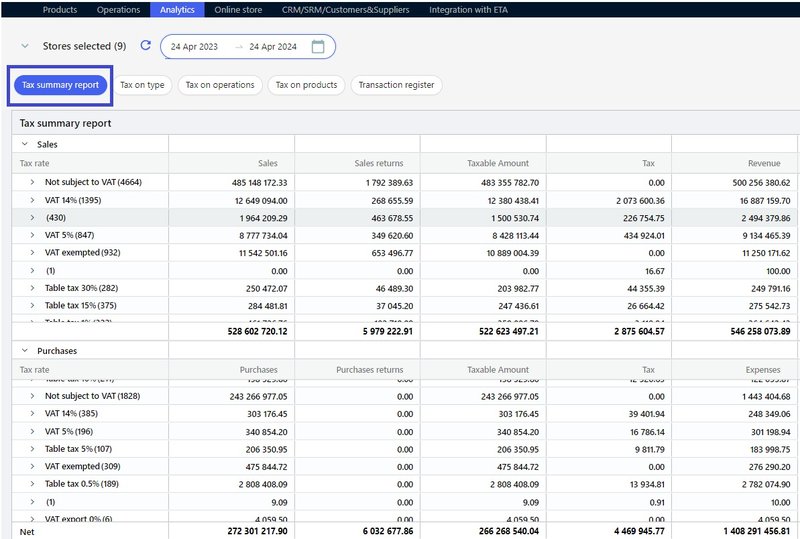

By default, it will be generated a Tax summary report on rates for all stores for the previous calendar month – Tax summary report.

The report includes the summary information on Sales, Sales returns, Purchases, Purchases returns, Revenue and Expenses.

Types of reports

- Tax summary report – shows the summary information about Tax amount on Sales, Sales returns, Purchases, Purchases returns, Revenue and Expenses. for the specified period for each rate by product type.

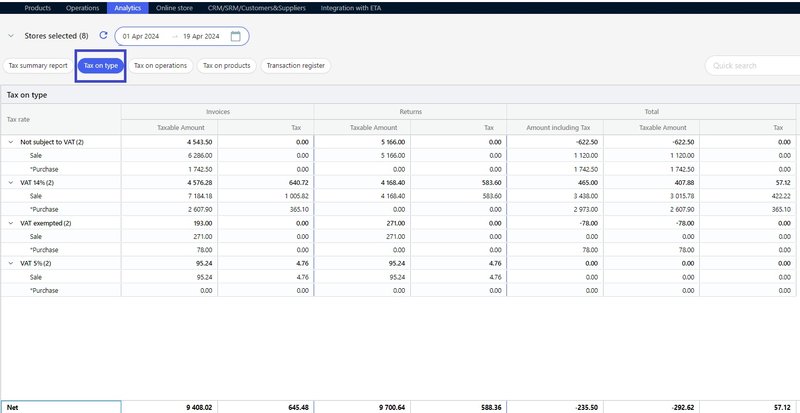

- Tax on type – a brief report can be used to view Tax rates by operations.

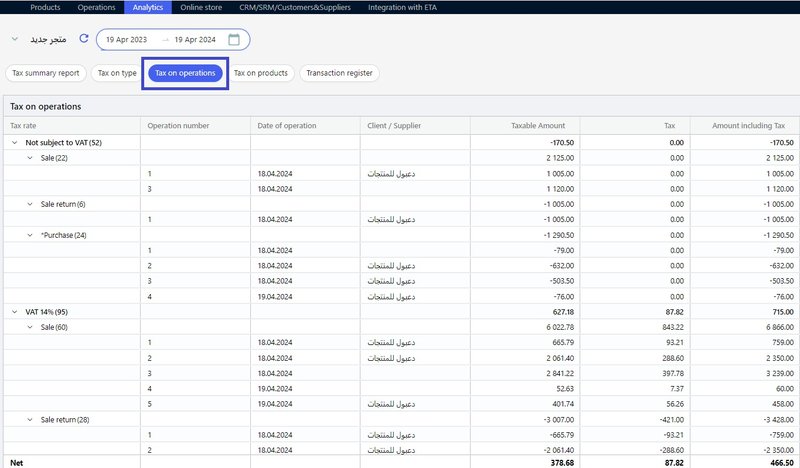

- Tax on operations - report can be used to check if the Tax charges are correct for each Sale, Sale return and Purchase operation.

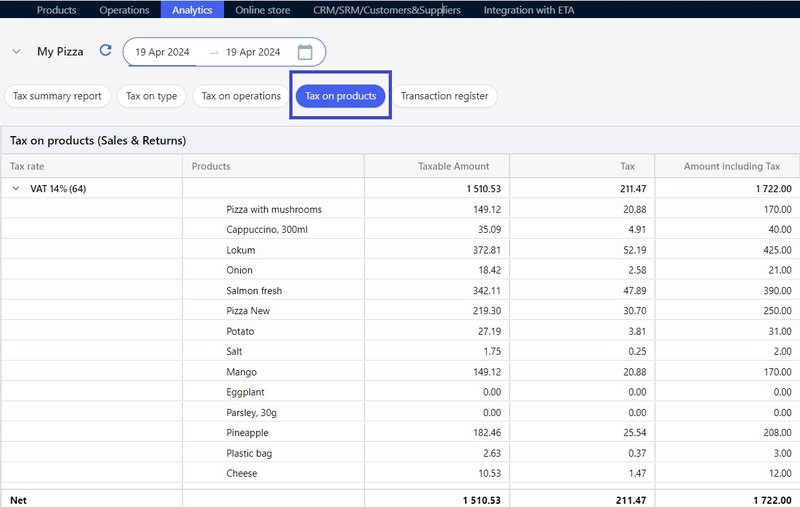

- Tax on products – you can see in this report what products have been included in the calculation for each Tax rate and check if the Tax charges by rates and amounts for each product are correct.

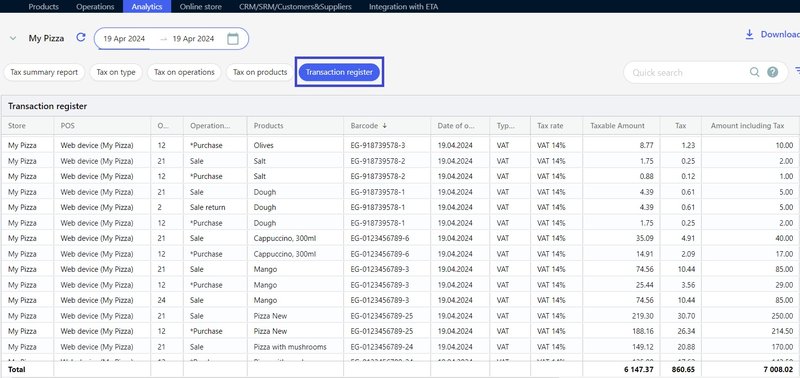

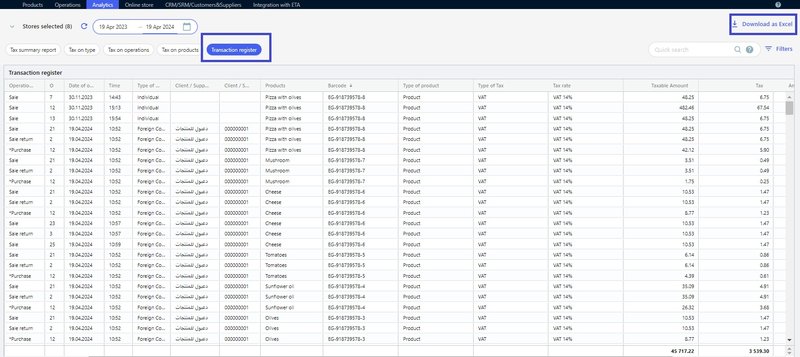

- Transaction register – it’s a full register of all operations to view the data of each product from each operation, Sale, Sale return, Purchase amounts, Tax rates and amounts for a set period.

You can upload the Transaction register in Excel format: click Download as Excel on the control panel and save the report to your computer.

Setting up the report display

You can set the display of the report according to your purposes:

- Generate a report for individual stores: click on the Stores selected () and mark the stores.

- To change the period of the report display: select the date in the calendar or use the pre-set settings, e.g., Last week or 3 months.

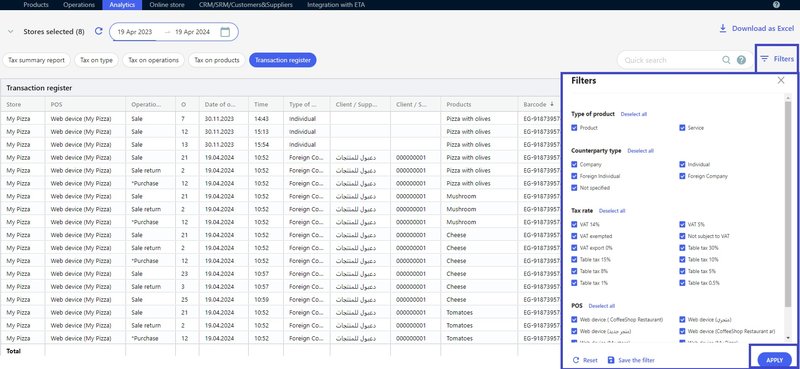

- Use filters: select Type of product, Tax rate , Counterparty type, POS.

To quickly find the operations by counterparties, products use the Quick search field.